The TaxCloud module allows you to calculate the sales tax for every address in the United States and keeps track of which product types are exempt from sales tax and in which states each exemption applies. TaxCloud calculates sales tax in real-time for every state, city, and special jurisdiction in the United States.

Configuration

Install the TaxCloud module

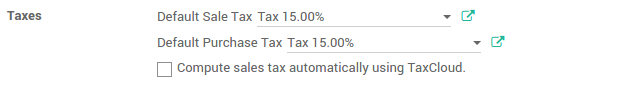

In the Accounting module, click on . Under , check the box Compute sales tax automatically using TaxCloud.

Configure TaxCloud API

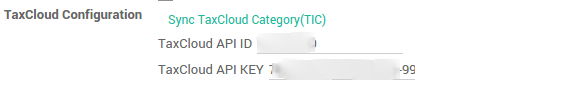

To configure your TaxCloud API, go to the Accounting module, click on . ** Under TaxCloud Configuration enter your account credentials (API ID and API Key). For more information, please refer to the *Taxcloud* website.

Synchronize the TICs(Taxability Information Codes) category

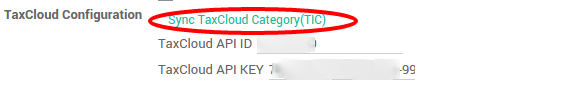

After connecting to TaxCloud API, click on Sync TaxCloud Category (TIC) to synchronize the TICs(Taxability Information Codes) for products.

Company configuration

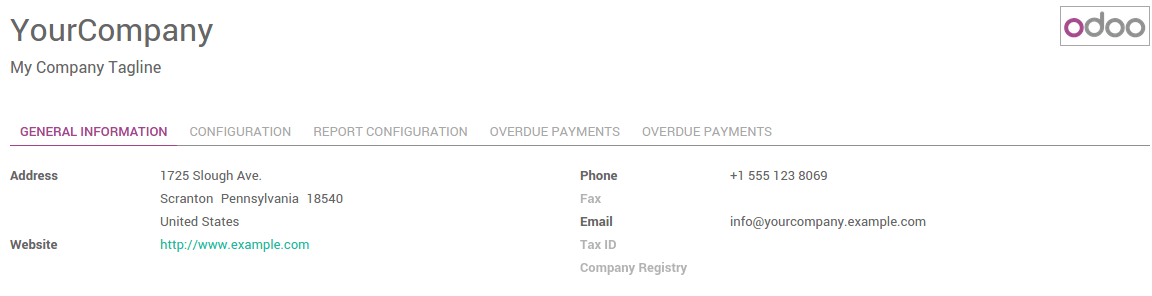

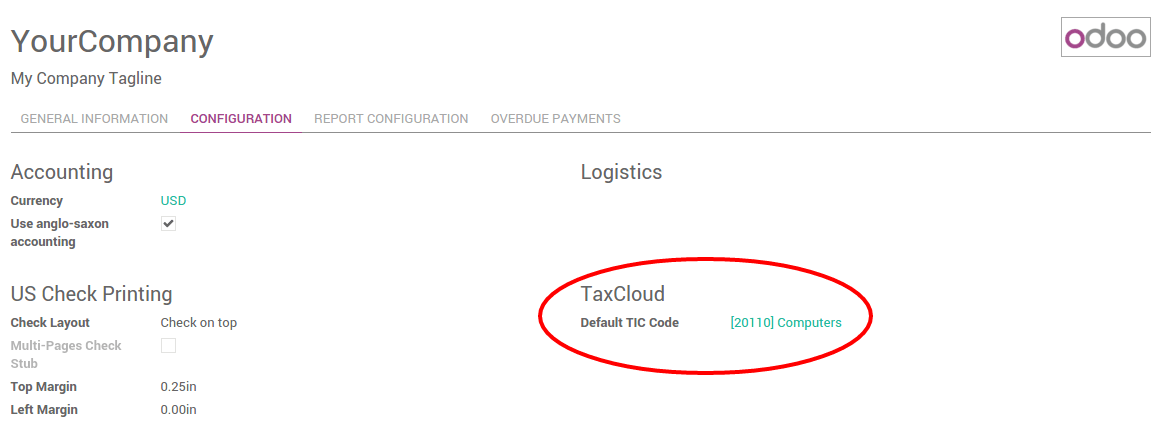

In order to compute the right tax rate, the provider needs your company information. Be sure your address and default TIC category are correctly encoded.

Set default TIC category on your company. This ensures if you are selling the same TIC category product you aren’t required to fill the TIC on each product or in case of a missing TIC category on product it will automatically reference the default category for your company.

To check your information, go to the Settings app and click on General Settings. Next, click Configure your company data.

Product configuration

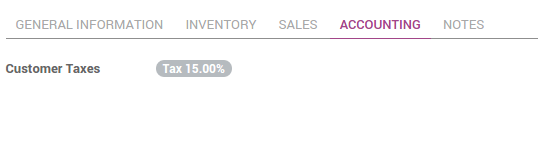

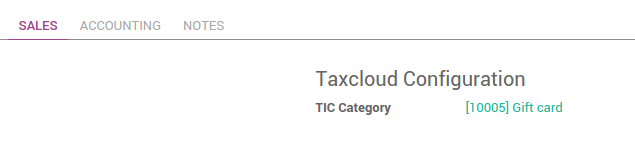

Set the correct sales tax and TIC category on the product. The main taxes are automatically configured according to the US chart of accounts.

If you want to set a specific tax rate on a product, you can set the sales tax on the product form under the Accounting tab.

You can set the TIC Category on the Product form under the Sales tab.

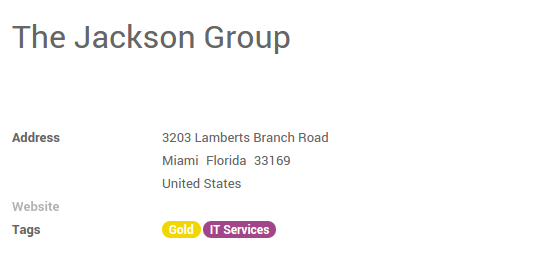

Customer configuration

In order to compute the correct tax, the provider needs customer information. Be sure your customer address is correctly encoded.

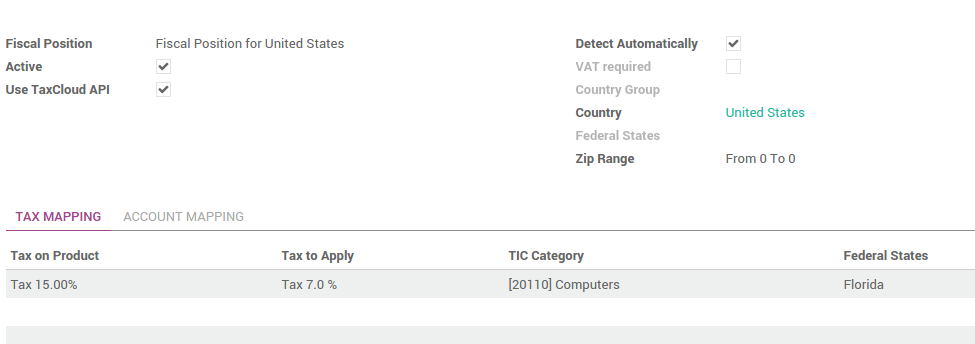

The main fiscal positions are automatically created for TaxCloud in the US by default but you may need to create additional fiscal positions for specific user cases.

To define fiscal position:

- Navigate to the Accounting app

- Go to

- Default fiscal position (country) is set to US (you can define the fiscal position in the Customer Form of the Accounting tab).

For more information on fiscal position, see the Odoo documentation on How to apply specific taxes by country, state or city?.

Manage your sales tax

Get sales tax automatically via TaxCloud

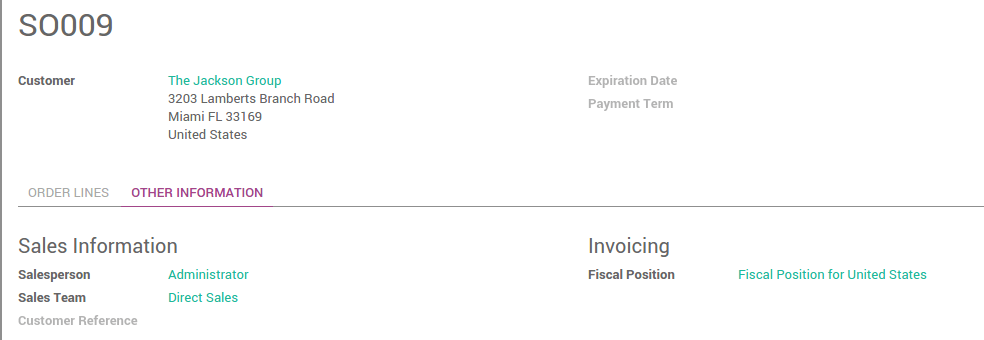

When the fiscal position(tax mapping on fiscal position) is applied (automatically) on a sales order, web order, or invoices it will send a request to TaxCloud and return a sales tax calculation.

For example, to get sales tax automatically on a sales order: In the main menu click and create a new sales order. Select a customer in the United States and TaxCloud will automatically apply the US fiscal position on the sales order.

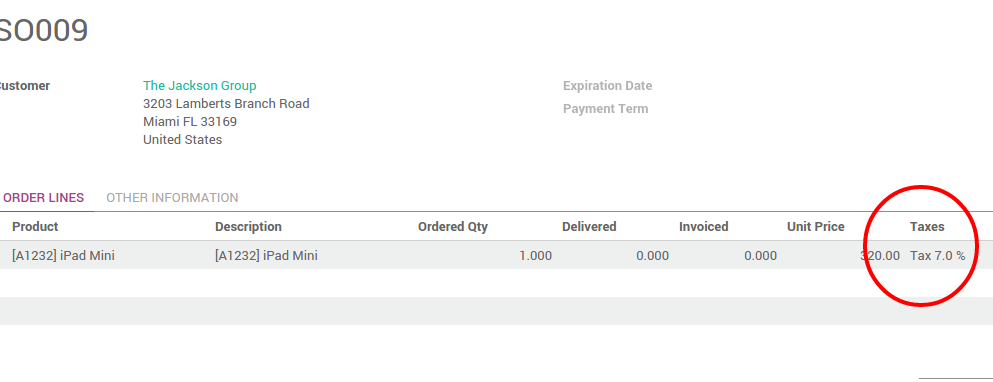

Add a product with sales tax on an order line and Odoo will automatically send a request to TaxCloud, get the correct tax percentage based on the customer’s State and Product TIC category, create a new tax rate if that tax percentage does not already exist on your list and return the new tax rate (example: 7.0%).

You can also add a tax mapping line on the fiscal position with the new tax. Odoo will check if the tax exists for the customer's State and product TIC category in the fiscal position mapping line and if it does not exist it will send a request to TaxCloud to retrieve the new tax rate.